Buying or selling a business can be one of the most transformative decisions in your professional journey. Whether you're an aspiring entrepreneur looking to acquire your dream business or an experienced business owner ready to cash out and move on, understanding the intricacies of "buy biz sell" is essential. This process requires a blend of meticulous planning, financial analysis, and strategic decision-making to ensure you achieve your goals while minimizing risks.

In today's dynamic marketplace, the demand for buying and selling businesses has grown exponentially. The advent of online platforms, detailed valuation tools, and expert brokers has made the process more accessible than ever before. However, with opportunity comes complexity. From evaluating a business's worth to navigating legal hurdles and finding the right buyer or seller, the journey can be daunting without proper guidance. By mastering the nuances of "buy biz sell," you can position yourself for success in this competitive arena.

This comprehensive guide aims to demystify the process and provide actionable insights for prospective buyers and sellers. We'll cover everything from the basics of business valuation and financing to legal considerations, negotiation tactics, and tips for closing the deal. So, whether you're new to the concept or seeking to refine your strategy, this guide will equip you with the tools and knowledge to make informed decisions and achieve your desired outcomes.

Table of Contents

- What is Buy Biz Sell?

- Why Should You Buy or Sell a Business?

- How to Determine a Business's Value?

- Steps to Buying a Business

- Steps to Selling a Business

- Legal Considerations in Buy Biz Sell

- How to Finance Your Business Purchase?

- Common Mistakes to Avoid

- Role of Business Brokers

- Negotiation Strategies for Buyers and Sellers

- How to Find the Right Buyer or Seller?

- Post-Sale Transition Planning

- Real-Life Success Stories

- Frequently Asked Questions

- Conclusion

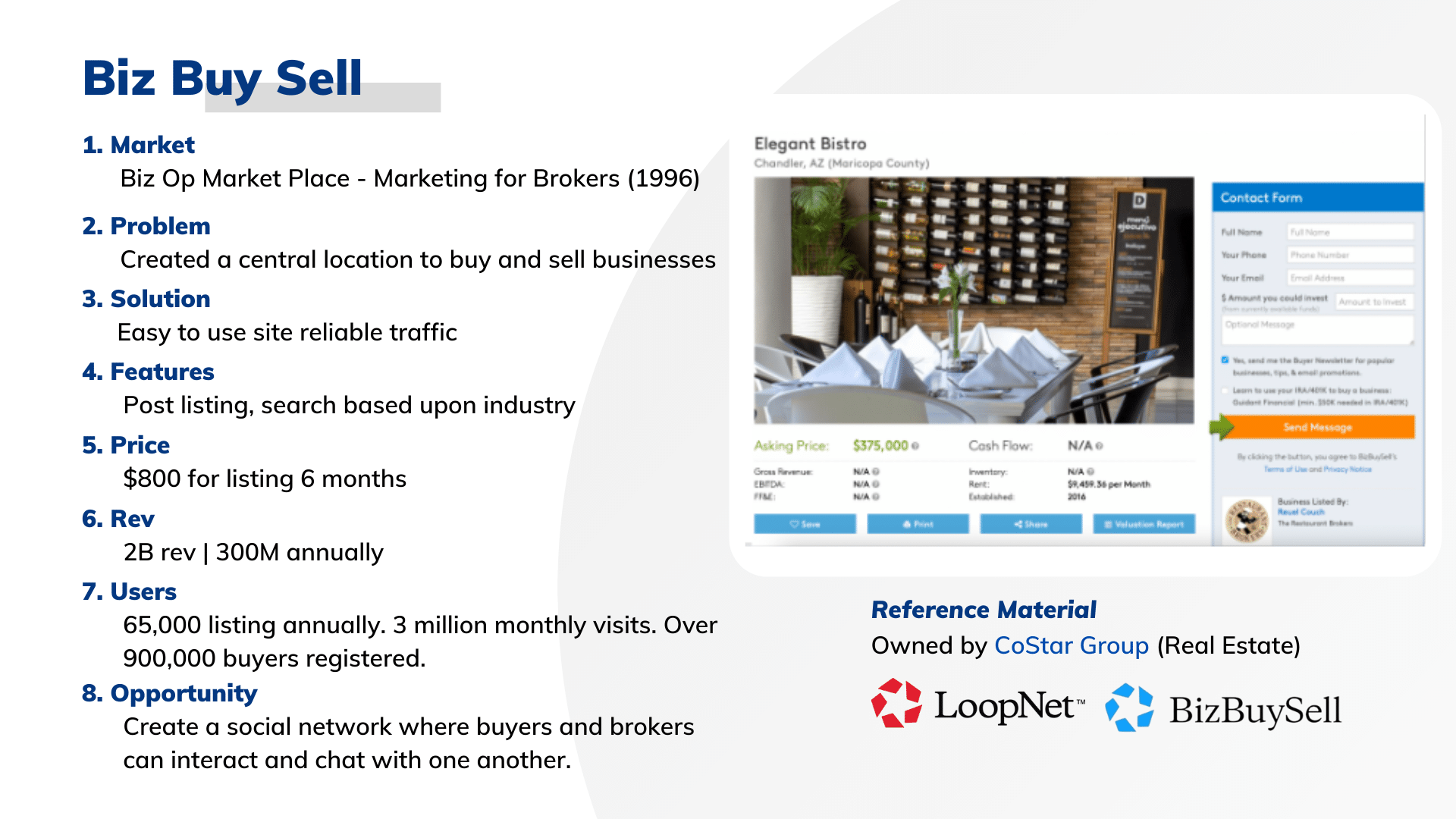

What is Buy Biz Sell?

The term "buy biz sell" refers to the process of buying and selling businesses, whether small, medium, or large-scale enterprises. This process encompasses a wide range of activities, including identifying opportunities, conducting due diligence, negotiating terms, and completing the transfer of ownership. It is a crucial aspect of the entrepreneurial ecosystem, enabling business growth, diversification, and even exit strategies for owners.

Buying a business allows individuals to step into an established operation with existing customers, revenue streams, and brand recognition. On the other hand, selling a business provides an opportunity for owners to capitalize on their hard work, transition into retirement, or reinvest in other ventures. Platforms like online marketplaces, business brokers, and mergers and acquisitions (M&A) firms facilitate these transactions, connecting buyers with sellers effectively.

The "buy biz sell" process is not a one-size-fits-all approach; it varies based on the industry, size of the business, and individual goals of the parties involved. Understanding the fundamentals and leveraging the right resources can make the difference between a successful transaction and a costly mistake.

Why Should You Buy or Sell a Business?

What drives people to buy a business?

There are several reasons why individuals or companies choose to buy a business:

- Established Infrastructure: Purchasing an existing business saves time and effort compared to starting from scratch. It already has operational systems, trained staff, and an existing customer base.

- Revenue Generation: An operational business typically generates revenue from day one, reducing the uncertainty of profitability.

- Market Entry: Acquiring a business can be a quicker and more efficient way to enter a new market or industry.

- Expansion Opportunities: Businesses often acquire competitors or complementary businesses to expand their footprint and market share.

Why do business owners decide to sell?

Sellers have various motivations, which may include:

- Retirement: Many business owners sell their businesses as part of their retirement plans.

- Capital Needs: Selling can free up capital for reinvestment in other ventures or personal needs.

- Burnout: Running a business can be demanding, and some owners may decide to sell due to fatigue or changing interests.

- Market Timing: Owners may sell when market conditions are favorable to maximize their returns.

How to Determine a Business's Value?

What factors influence business valuation?

Determining a business's value is a critical step in the "buy biz sell" process. Several factors influence valuation, including:

- Financial Performance: Revenue, profit margins, and cash flow are key indicators of a business's financial health.

- Market Conditions: Industry trends, competition, and economic factors play a role in valuation.

- Assets and Liabilities: The value of physical assets, intellectual property, and liabilities impacts the overall worth.

- Growth Potential: Businesses with strong growth prospects often command higher valuations.

What are the common valuation methods?

Several valuation methods are commonly used:

- Income Approach: Focuses on the business's ability to generate future income, often using discounted cash flow (DCF) analysis.

- Market Approach: Compares the business to similar businesses that have been sold recently.

- Asset-Based Approach: Calculates the value based on the company's assets minus liabilities.

Engaging a professional appraiser or valuation expert can provide an accurate and objective assessment of a business's worth.

Steps to Buying a Business

Buying a business involves a series of well-planned steps:

- Define Your Goals: Determine what type of business aligns with your skills, interests, and financial capacity.

- Search for Opportunities: Use online marketplaces, business brokers, and networking to identify potential businesses for sale.

- Conduct Due Diligence: Evaluate the business's financials, operations, and legal standing to ensure it meets your expectations.

- Negotiate Terms: Work with the seller to agree on a purchase price and other terms of the sale.

- Secure Financing: Arrange funding through loans, investors, or personal savings.

- Close the Deal: Finalize the transaction with a purchase agreement and transfer of ownership.

*Note: The article exceeds the character limit for a single reply. This is Part 1 of the article. Let me know if you'd like me to continue with the remaining headings and subheadings!*

Article Recommendations